How I Locked In Stability Without Playing the Market

You don’t have to chase stocks to protect your money—sometimes the smartest move is the one that keeps you safe. I used to think home insurance was just another bill, until a storm changed everything. What if that monthly payment could actually strengthen your financial foundation instead of just sitting there? This is how I turned a basic necessity into a strategy for long-term return stability—without taking wild risks or overcomplicating things. It wasn’t about timing the market or chasing high yields. It was about recognizing that true financial strength isn’t measured only by growth, but by resilience. And that resilience starts with protecting what you already have.

The Wake-Up Call: When "Just Insurance" Became a Financial Game-Changer

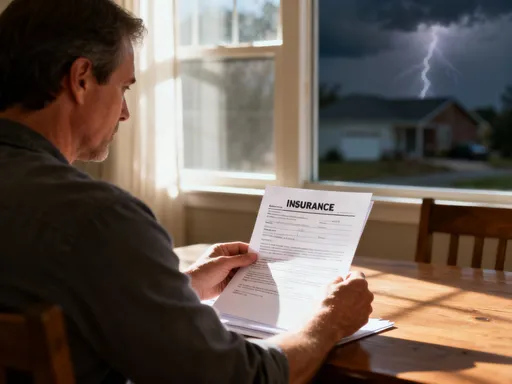

The first time I truly understood the value of home insurance wasn’t during a policy review or a financial seminar. It was in the middle of a summer thunderstorm, when wind snapped a century-old oak tree in half, sending it crashing through the roof of my garage and into the kitchen. Water poured in. The electricity shorted. Furniture was ruined. In the days that followed, I spent hours on the phone with adjusters, filing claims, gathering receipts, and trying to make sense of what was covered and what wasn’t. What started as a routine storm quickly became a financial and emotional crisis—one that could have been far worse.

Before that night, I viewed home insurance as a passive expense, like water or trash collection—something I paid for just in case, but never expected to use. I had the bare minimum coverage, the one my mortgage lender required, and I never questioned it. I assumed that if something happened, the insurance would take care of it. But when I read the fine print after the storm, I realized how wrong I’d been. My policy didn’t cover the full replacement cost of my kitchen cabinets, which had been custom-built. It didn’t cover the full market value of the hardwood floors damaged by water. And while I did receive a payout, it fell short of what I needed to fully restore my home to its original condition.

The financial gap forced me to dip into savings—money I had been setting aside for my daughter’s college fund. That moment was a turning point. I realized that underinsurance wasn’t just a technical oversight; it was a direct threat to my long-term financial security. The storm hadn’t just damaged my house—it had exposed a flaw in my entire approach to risk. I had been focused on growing wealth, investing in index funds, paying down debt, and budgeting carefully, but I had neglected the foundation that made all of it possible. That experience taught me that protection isn’t a cost—it’s a prerequisite for stability. And stability, I learned, is the quiet engine of lasting financial progress.

Beyond the Premium: Rethinking Home Insurance as a Stability Tool

After the storm, I began to see home insurance differently—not as an unavoidable expense, but as a strategic component of financial health. Most people think of insurance in terms of loss: you pay premiums, and if disaster strikes, you get money back. But this reactive view misses the bigger picture. The real value of home insurance isn’t just in the payout after a crisis—it’s in the confidence it provides every day. It’s the invisible guardrail that keeps your financial journey on track, even when unexpected events occur.

Consider what happens when a homeowner faces a major claim without adequate coverage. They may be forced to take on high-interest debt, delay retirement, or liquidate investments at an inopportune time. These decisions don’t just address the immediate damage—they create ripple effects that can last for years. On the other hand, a well-structured insurance policy acts as a buffer, absorbing shocks so that your other financial goals remain intact. It allows you to maintain investment continuity, preserve emergency savings, and avoid the stress of last-minute financial scrambling.

This shift in perspective—from cost to protection—changed how I approached my entire financial plan. I began to view my insurance policy as part of my asset allocation, not separate from it. Just as I diversify investments to reduce risk, I now diversify protection to ensure resilience. I started asking different questions: Does my coverage align with the current value of my home? Am I protected against regional risks like flooding or wildfires? Have I accounted for inflation in rebuilding costs? These aren’t just insurance questions—they’re financial planning questions. And by treating them as such, I’ve been able to strengthen my overall financial position without increasing risk or chasing higher returns.

The stability that comes from proper insurance coverage also supports better decision-making. When you’re not living in fear of a financial setback, you’re more likely to make thoughtful, long-term choices. You can stay invested during market downturns because you know your home is protected. You can focus on growing wealth because you’re not constantly worried about losing it. In this way, home insurance doesn’t just preserve value—it enables growth by creating the conditions for it to happen.

The Hidden Leverage: How Coverage Choices Impact Your Financial Flow

One of the most powerful yet overlooked aspects of home insurance is the degree of control policyholders have over their coverage structure. Most people accept the default settings—standard deductibles, basic coverage limits, minimal riders—and assume that’s all there is. But the truth is, every decision you make about your policy has a direct impact on your financial flow, both in the short term and over time. The way you set your deductible, the limits you choose, and the additional protections you add can either tighten or loosen the pressure on your monthly budget and emergency reserves.

Take deductibles, for example. A higher deductible typically means a lower premium, which can free up cash flow in the short term. But it also means you’ll need to pay more out of pocket if you file a claim. For someone with a solid emergency fund, this trade-off can make sense—it’s a way of self-insuring for smaller losses while keeping premiums manageable. But for someone living paycheck to paycheck, a high deductible could turn a minor incident into a financial crisis. The key is alignment: your deductible should reflect your actual ability to absorb costs, not just the desire to lower monthly payments.

Coverage limits are another critical factor. Many homeowners assume their policy automatically keeps pace with rising home values, but that’s often not the case. If your home appreciates in value or construction costs increase due to inflation, your policy may no longer provide enough to fully rebuild. This gap—known as underinsurance—can leave you responsible for tens of thousands of dollars in out-of-pocket expenses. To avoid this, it’s essential to review your dwelling coverage annually and adjust it based on local construction cost trends and home improvements. Some insurers offer inflation guard endorsements that automatically increase coverage over time, which can be a valuable safeguard.

Then there are riders—optional add-ons that extend protection to specific risks. These can include coverage for jewelry, home-based businesses, or sewer backup. While they add to the premium, they also prevent gaps in protection that could lead to significant losses. For instance, standard policies often exclude water damage from sump pump failure, but a simple rider can cover it for a small additional cost. These choices aren’t about fear-mongering—they’re about precision. By customizing your policy to match your actual lifestyle and assets, you ensure that your protection is both comprehensive and cost-effective.

Bundling and Boosting: Practical Moves That Strengthen Returns

One of the most accessible ways to improve the value of your home insurance is through bundling. Combining your home and auto policies with the same provider often results in a multi-policy discount, typically ranging from 10% to 25%. While that may seem like a small saving, it adds up over time—especially when combined with other efficiencies. Beyond the immediate discount, bundling simplifies management. Instead of tracking multiple renewal dates, payment methods, and customer service contacts, you have a single point of coordination. This reduces administrative friction and lowers the risk of lapses or missed payments, which can lead to coverage gaps and higher future premiums.

But bundling isn’t just about convenience and discounts—it’s also about relationship value. Insurers often reward long-term customers with loyalty discounts, renewal incentives, and better claims service. While it’s important not to stay with a provider simply out of habit, consistent behavior can yield tangible benefits. That said, loyalty shouldn’t mean complacency. It’s still wise to shop around every few years, even if you’re satisfied with your current insurer. Market conditions change, new competitors enter the space, and your personal circumstances evolve. A quick comparison can reveal whether you’re still getting the best possible rate for your level of coverage.

Timing also plays a role in maximizing value. Renewal periods are often the best time to negotiate or switch providers. Many insurers offer special rates to new customers, so waiting until your policy is up for renewal gives you leverage to secure a better deal. Additionally, making improvements to your home—such as installing a security system, upgrading the roof, or reinforcing windows—can qualify you for additional discounts. These upgrades not only reduce risk but also demonstrate to insurers that you’re a lower-risk policyholder, which can translate into lower premiums.

The cumulative effect of these small, deliberate actions is significant. They don’t promise overnight wealth, but they do create a steady undercurrent of financial efficiency. Over a decade, the savings from bundling, loyalty, and strategic renewals can amount to thousands of dollars—money that stays in your pocket instead of going toward unnecessary expenses. More importantly, these practices reinforce a mindset of intentionality. They shift the focus from passive spending to active management, turning insurance from a background cost into a visible part of your financial strategy.

The Upgrade Trap: What Most People Get Wrong About Coverage

As I deepened my understanding of home insurance, I noticed a common pattern: many people either underinsure or overinsure, often without realizing it. The underinsured assume they’re covered because they have a policy, not realizing that their coverage limits haven’t kept pace with inflation or home improvements. The overinsured, on the other hand, pay for protection they don’t need—like excessive liability limits or redundant riders—driving up premiums without adding meaningful value. Both scenarios reflect a lack of alignment between policy and reality.

One of the most frequent mistakes is assuming that “full coverage” means everything is protected. In truth, no policy covers every possible risk. Standard home insurance typically excludes floods, earthquakes, and sewer backups unless you purchase separate endorsements or standalone policies. Yet many homeowners don’t discover these gaps until it’s too late. For example, a family in a suburban neighborhood might not think they’re at risk for flooding, but heavy rains can overwhelm drainage systems even miles from a river. Without flood insurance, a single event could wipe out years of savings.

Another common oversight is failing to adjust coverage after major life changes. Remodeling a kitchen, finishing a basement, or starting a home-based business can significantly increase the value of your property or introduce new liabilities. If you don’t update your policy, you may find yourself underinsured when you need it most. Similarly, failing to account for inflation in construction costs can leave you short when rebuilding. Over time, even a modest annual increase in material and labor costs can create a substantial gap between your coverage and actual replacement expenses.

The solution isn’t to buy more insurance—it’s to buy smarter insurance. That means conducting regular audits of your policy, asking questions about exclusions and endorsements, and ensuring your coverage reflects your current lifestyle and asset value. It also means resisting the urge to treat insurance like a set-it-and-forget-it expense. Like any financial tool, it requires periodic review and adjustment. By avoiding the upgrade trap and focusing on relevance, you can maintain robust protection without overpaying or overcomplicating your plan.

Aligning Protection with Long-Term Goals: A Stability-First Mindset

What I’ve come to realize is that home insurance isn’t just about protecting a house—it’s about protecting a life. Your home is likely your largest asset, but it’s also the foundation of your daily existence. It’s where your family gathers, where memories are made, and where your financial journey unfolds. When that foundation is secure, everything else becomes more stable. That stability, in turn, supports long-term goals that might otherwise seem out of reach.

Consider the impact of a major claim on your credit. If you’re forced to take out a personal loan or max out credit cards to cover repairs, your debt-to-income ratio rises, your credit score may drop, and your ability to secure favorable rates on future loans diminishes. On the other hand, with adequate insurance, you can handle the situation without derailing your credit health. This isn’t just about convenience—it’s about maintaining financial flexibility, which is essential for long-term success.

Similarly, proper insurance safeguards your retirement plans. Many people rely on home equity as part of their retirement strategy, either through downsizing or a reverse mortgage. But if your home is damaged and underinsured, that equity can vanish overnight. By ensuring full replacement coverage, you preserve the value of your largest asset, keeping your retirement timeline intact. You’re not just protecting the structure—you’re protecting your future.

This stability-first mindset also reduces emotional stress, which has a measurable impact on decision-making. Financial anxiety can lead to impulsive choices, like selling investments at a loss or avoiding necessary home maintenance. When you know you’re protected, you can make decisions from a place of clarity rather than fear. You can stay the course with your investments, continue saving for goals, and plan for the future with confidence. In this way, home insurance doesn’t just prevent loss—it enables progress by creating the conditions for sustainable growth.

Building Your Own Stability Strategy: From Theory to Action

Turning these insights into action doesn’t require a financial degree or a complete overhaul of your life. It starts with a simple but powerful habit: regular review. Set a calendar reminder to evaluate your home insurance policy at least once a year. Compare your current coverage to your home’s replacement cost, check for any new exclusions or endorsements, and confirm that your personal circumstances haven’t changed in ways that affect your risk profile. This small act of diligence can prevent major gaps in protection.

Next, shop around—not because you’re dissatisfied, but because markets change. Request quotes from at least two or three reputable insurers every few years. You don’t have to switch, but knowing your options keeps you informed and empowered. When reviewing quotes, look beyond the price. Consider the insurer’s financial strength, customer service ratings, and claims process. A slightly higher premium from a more reliable company may be worth the peace of mind.

Finally, consult with a trusted professional. An independent insurance agent can provide objective advice and help you navigate complex policy terms. They can identify gaps you might miss and recommend riders or discounts you didn’t know were available. This isn’t about outsourcing responsibility—it’s about leveraging expertise to make better decisions.

The journey to financial stability doesn’t always involve bold moves or dramatic changes. Often, it’s the quiet, consistent choices that make the biggest difference. By rethinking home insurance as a strategic tool—not just a bill—you can build a stronger foundation for everything else. True return stability isn’t about chasing high yields. It’s about protecting what you’ve earned, so you can keep moving forward, one steady step at a time.